Top Social Media Platforms in Hong Kong 2025 | Usage Trends & Marketing Insights

Want to save time?

Summarize this article in seconds with AI

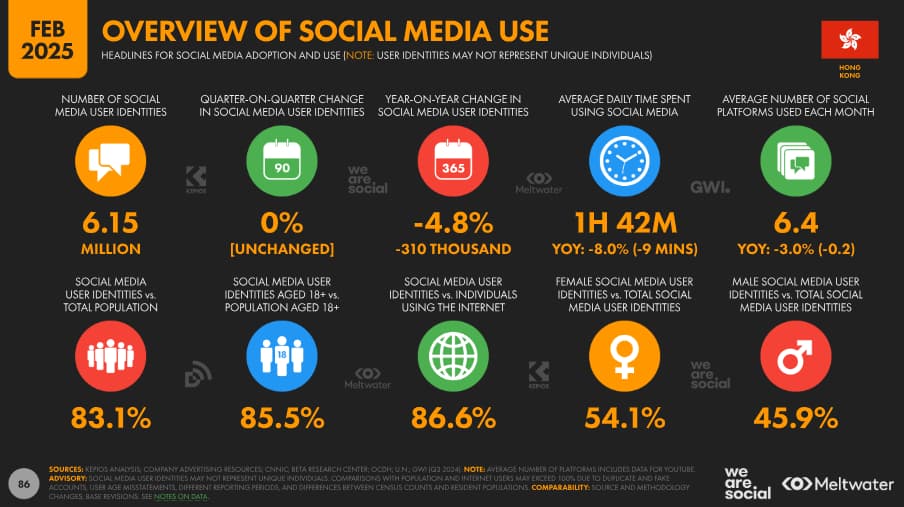

Hong Kong social media penetration exceeds 83%, brands must understand the unique user behaviour and characteristics of each local platform to capture attention, boost conversions, and build trust. As the city’s digital ecosystem becomes increasingly mature in 2025, user habits continue to evolve rapidly. This article breaks down the real influence and marketing value of Hong Kong's major social media platforms through data, analysis, and strategic recommendations.

1. Overview of Social Media Usage in Hong Kong

Hong Kong has a total population of about 7.4 million, with approximately 7.1 million being internet users (around 96% penetration).

Around 6.15 million people use social media, accounting for about 83% of the total population.

On average, Hong Kong users actively use 6.4 social media platforms, spending about 1.4 hours daily on social media.

- 54% of social media users are female, while 45.9% are male.

This means:

→ Users are highly fragmented, making it difficult for a single platform to achieve full reach

→ Multi-platform strategies with differentiated content are becoming the norm

→ Understanding "social media ranking 2025" is not only about media choices, it’s a strategic move for aligning brand and market fit

2. Ranking of Major Social Media Platforms in Hong Kong (2025)

Here are the most used social media in Hong Kong:

| Rank | Platform | Usage Rate / Number of Users | Remarks |

|---|---|---|---|

| 1 | Facebook / WhatsApp | Approximately 70.6% each (about 4.55 million users) | Tied for first place as the most used social and messaging platforms |

| 2 | YouTube | Reach rate around 83.1% (about 6.15 million users) | Video platform popular across all age groups |

| 3 | About 58% (around 3.7 million users) | Preferred by younger audiences; 93% usage among students | |

| 4 | TikTok / Douyin | Approximately 2% (adult users) | Ad reach growing rapidly; increasing influence of short videos |

| 5 | Threads | About 16.6% (around 1.07 million users) | Emerging text-based platform with growing adoption |

| 6 | Xiaohongshu (RED) | No precise statistics | High female user ratio; strong value for cross-border marketing |

| 7 | Messenger / Telegram / Snapchat | Messenger ~25%, others lower | Not mainstream but used for specific functions |

Also read:

3. Most Followed Social Media Account Types in Hong Kong

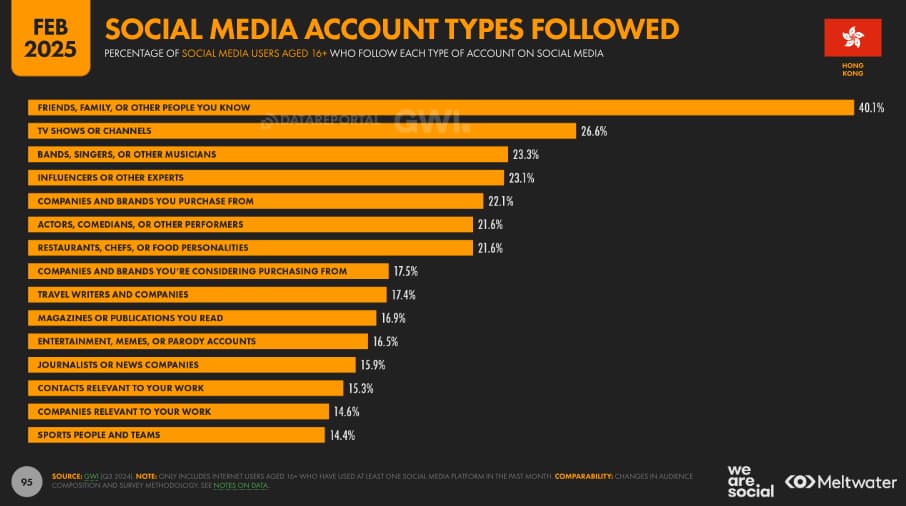

According to the 2025 report by We Are Social and Meltwater, here are the most followed account types among Hong Kong social media users aged 16 and above:

Friends and acquaintances (40.1%): Reflects that the core of social media is still interpersonal connections.

TV shows/channels (26.6%), singers/musicians (23.3%), actors/performers (21.6%): Entertainment content remains consistently popular.

KOLs/experts (23.1%): Indicates that credibility and individual influence are still trusted sources for users.

Brands previously purchased (22.1%) and brands being considered (17.5%): Suggests that brand accounts need to be relatable and valuable, not just promotional.

Food content (restaurants/chefs) (21.6%) and travel accounts (17.4%): Everyday lifestyle content has high engagement and emotional resonance potential.

These numbers highlight three key insights:

Social reach comes from shares and emotional connection

If your content is share-worthy and sparks users to tag their friends, it's often more effective than paid ads. Brands should leverage UGC (user-generated content), storytelling, and interactive post formats.Balance between entertainment and information

Hong Kong users follow not only for fun but also for value, insight, or knowledge. This opens two routes for content: emotional storytelling (e.g., behind-the-scenes, KOL collabs) and rational delivery (e.g., product education, brand values).Brand accounts need a human touch

Users are more willing to follow brands they’ve already purchased from than unfamiliar ones, meaning trust and familiarity are critical. To attract cold traffic, brands must offer sincere content value, not just hard selling.

4. Platform Characteristics and Marketing Recommendations

Facebook / WhatsApp

Ideal for creating brand pages, running promotional campaigns, and handling customer service. WhatsApp Business also offers auto-replies, customer support, and conversion tools.

YouTube

Whether it’s for tutorials or brand storytelling, YouTube supports both long and short videos. YouTube Shorts viewership is steadily rising in Hong Kong.

Instagram

Visual-first platform ideal for lifestyle brands and product showcases. Instagram Reels have seen a noticeable increase in engagement.

TikTok

A short-video-driven platform known for fast viral spread and audience interaction. Ideal for challenges and viral campaigns. Rapidly growing popularity among younger Hongkongers.

Threads

A text-based platform focused on dialogue and conversation. Key for shaping brand voice, persona development, and real-time interaction. Still building its user base but shows promising potential.

Xiaohongshu (RED)

A hub for cross-border eCommerce and lifestyle content, particularly effective in reaching women aged 25–40. Works well for soft promotions, unboxings, reviews, and how-to content.

5. Trends and Marketing Strategy Recommendations

1. Cross-Platform Integration:

Use Facebook and WhatsApp as your foundation, then expand your content strategy across Instagram, YouTube, and TikTok.

2. Customized Content Creation:

Tailor your content format and tone based on each platform’s strengths. For example, use YouTube for in-depth explainer videos and Instagram for short, product-focused clips.

3. Performance Tracking and Optimization:

Leverage tools like Meta Insights, Google Analytics, and YouTube Studio to monitor performance. Optimize based on reach and engagement metrics.

4. Early Investment in Emerging Platforms:

For brands with a strong voice that aim to build close connections with users, platforms like Threads and Xiaohongshu (RED) offer new exposure opportunities.

6. A Practical Framework for Building a Social Media Strategy in the Hong Kong Market

| Stage | Practical Actions |

|---|---|

| Goal Setting | Brand awareness, event sign-ups, website traffic, conversions, user engagement |

| Platform Selection | Prioritize based on audience age, product category, and content production capabilities |

| Content Format | Reels, image-text posts, short videos, Stories, unboxing posts, tutorial videos |

| Ad Planning | Test different audiences with a small budget, evaluate performance across platforms, then focus resources |

| Performance Tracking | Use Meta Insights, GA4, YouTube Studio to track clicks and engagement |

5. Conclusion

The popularity of Hong Kong social media platforms is just the first layer of insight. What truly matters is whether the platform you choose fits your brand’s tone and available resources.

In 2025, Hong Kong is no longer in an era where “just doing Facebook” is enough. Brands need strategic thinking, strong content capabilities, and integrated resources to stand out in a crowded digital landscape.

If you're looking to develop a cross-platform social media strategy for your brand, feel free to contact us. Adintime offers practical, Hong Kong-specific marketing solutions tailored to your needs.

Cookie preferences

Cookie preferences

Xiaohongshu Advertising Guide: How Can Hong Kong Brands Maximize Their Results?

Xiaohongshu Advertising Guide: How Can Hong Kong Brands Maximize Their Results?

2x your advertising effectiveness: Master big data to optimize ad ROI

2x your advertising effectiveness: Master big data to optimize ad ROI

Top 5 Best Ads in 2025 in Hong Kong

Top 5 Best Ads in 2025 in Hong Kong

Hong Kong Outdoor Advertising Cost in 2026 | Adintime Report

Hong Kong Outdoor Advertising Cost in 2026 | Adintime Report

Marketing Calendar 2026: Key Dates For Marketing Success

Marketing Calendar 2026: Key Dates For Marketing Success

The Most Widely-Read Magazine and Newspaper in Hong Kong

The Most Widely-Read Magazine and Newspaper in Hong Kong

Understanding YouTube Advertising Costs in 2025

Understanding YouTube Advertising Costs in 2025

OOH /DOOH advertising in Hong Kong: Formats and Rates (2025 Update)

OOH /DOOH advertising in Hong Kong: Formats and Rates (2025 Update)

How much does LinkedIn Advertising Cost? (2025 Update)

How much does LinkedIn Advertising Cost? (2025 Update)

Top Social Media Platforms in Hong Kong 2025 | Usage Trends & Marketing Insights

Top Social Media Platforms in Hong Kong 2025 | Usage Trends & Marketing Insights