Finance Advertising: 7 Examples of Bank and Insurance Ads

In a sector as trust-dependent as finance, bland or overly technical advertising won't really stand out. Whether it’s a bank reassuring new customers or an insurer standing by in life’s hardest moments, financial ads work best when they tap into emotion, clarity, and cultural relevance.

Let’s break down 7 standout examples of bank advertising and insurance ads—from Hong Kong and abroad—that show how great finance marketing drives awareness, builds trust, and creates real business results:

- HSBC Hong Kong - "Life is Rarely a Straight Line" (2024)

- Revolut - "Money Possibilities" (2025)

- DBS Hong Kong - "Trust Your Spark" (2024)

- Chubb Life Hong Kong - "Every Wish Lasts" (2024)

- Bankwest - "Just Enough Bank" (2025)

- Prudential Hong Kong - "Entrust Multi-Currency Plan" Campaign (2025)

- Hang Seng Bank - "Chief Family Officer (CFO)" (2025)

1. HSBC Hong Kong – "Life is Rarely a Straight Line" (2024)

This HSBC advertisement is great because it communicates a complex brand promise (financial guidance through life’s uncertainties) in a simple, visual, and emotionally resonant way. It doesn’t try to push specific products like savings accounts or loans—instead, it promotes HSBC as a dependable long-term partner that’s ready for every twist and turn of a customer’s journey.

This is a bold shift away from traditional, product-centric bank advertising, which often feels transactional. Here, HSBC elevates the conversation to something more personal and human.

2. Revolut - "Money Possibilities" (2025)

In 2025, Revolut dials up its ambition, moving from fintech disruptor to full-fledged lifestyle brand. The campaign centers on a visually surreal film where a simple card tap opens up a world of personal finance possibilities—travel, investing, budgeting—all at your fingertips. Rather than focusing on features, the ad leans into aspiration and emotional payoff through the protagonist's imagination. The message is that Revolut is not just a traditional financial institution, but a passport to modern financial freedom. Rolled out across OOH/DOOH, digital, and audio platforms, it’s a polished brand play that aims to deepen loyalty and broaden appeal beyond early tech adopters.

3. DBS Hong Kong - "Trust Your Spark" (2024)

This 2024 bank advertising campaign combines emotional storytelling with interactive tech to inspire personal growth. At its core, the campaign encourages people to believe in their inner potential. A mobile AI Photo Generator toured Hong Kong, letting people visualize their future selves—whether as athletes, artists, or entrepreneurs—via personalized images. Participants were invited to share their dreams on social media with #TrustYourSpark, turning inspiration into community momentum. Supported by real-life stories and a multi-channel rollout, DBS successfully positioned itself as more than a bank: a partner in helping people achieve what truly drives them.

Here's an example of the AI photobooth results shared by a participant:

4. Chubb Life Hong Kong - “Every Wish Lasts” (2024)

This series of insurance ads takes a fresh, human approach to a topic most brands avoid—what we leave behind. Rather than selling life insurance in traditional terms, Chubb invites the public to reflect on personal legacy through community-driven art, film, and everyday conversations. The campaign kicked off with installations across Hong Kong posing reflective questions about life’s final wishes, sparking organic public response. From there, the brand hosted film screenings and creative experiences that helped bring the idea of legacy into daily life. By shifting the focus from policy details to human values, Chubb successfully repositioned life insurance as a conversation starter—and a tool for deeper connection between loved ones.

5. Bankwest - "Just Enough Bank" (2025)

This financial advertising campaign speaks directly to busy Australians in their 30s and 40s who don’t want a complicated relationship with their bank—they just want it to work. After closing its physical branches, Bankwest leaned into digital, promoting a newly redesigned app that strips away the clutter and focuses on what people actually need. The campaign, created with Bear Meets Eagle on Fire and EssenceMediacom, rolled out across outdoor advertising, TV ads, and digital platforms. It’s all about saving time, not wasting it. Driving home the message that banking doesn’t have to be a big deal to make a big difference.

6. Prudential Hong Kong – “Entrust Multi-Currency Plan” Campaign (2025)

In 2025, Prudential Hong Kong worked with pop star MC Cheung an insurance advertising campaign. The ad featured a savings insurance product designed for families planning long-term futures for their children. The plan allows policyholders to switch between six currencies, helping them adapt to global education or career paths. It also offers structured income options and legacy planning tools tailored to individual needs. To promote it, Prudential spotlighted real stories, like a young Hong Kong singer, a 10-year-old Shanghai photographer, and a breakdancer, showing how the right financial support can help kids pursue their passions with confidence.

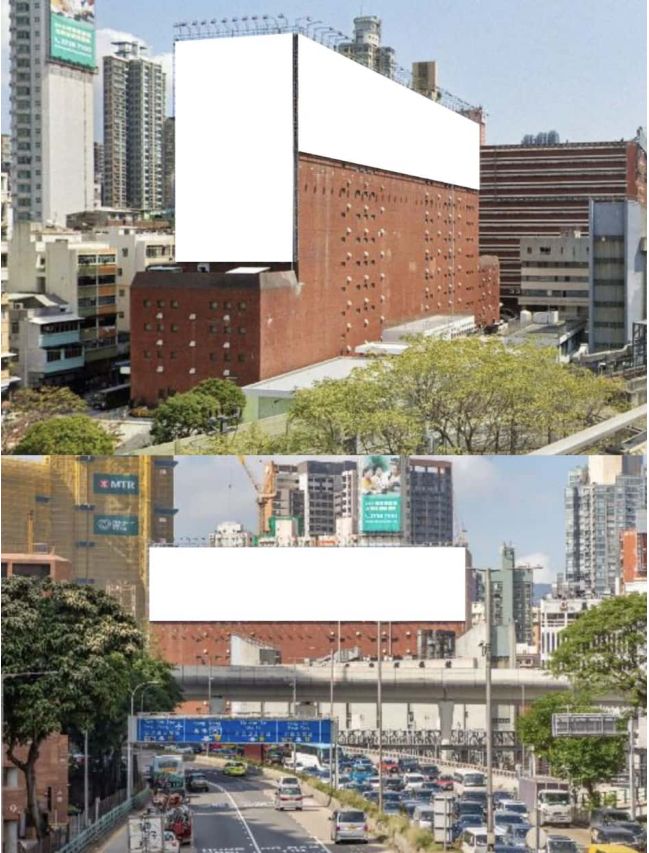

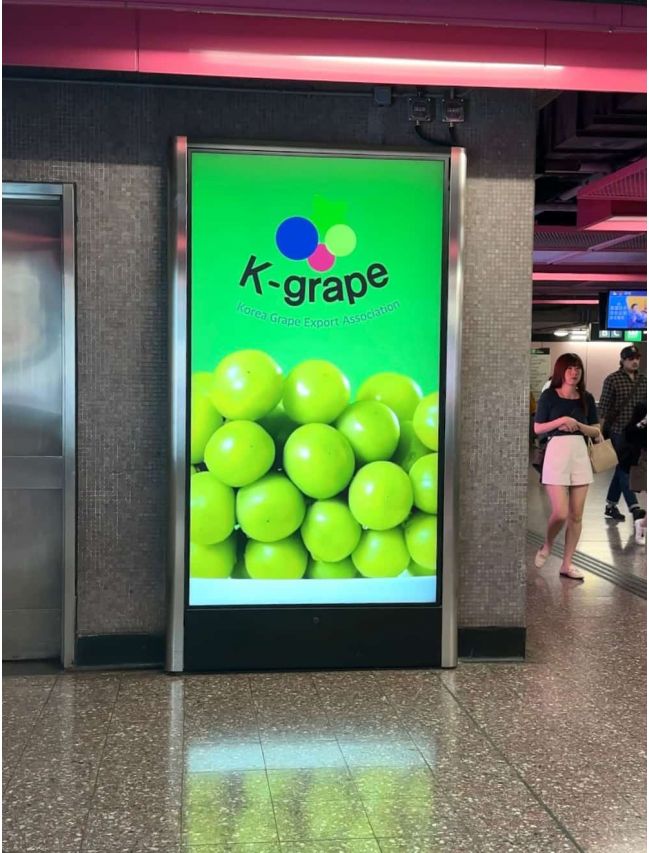

This large-scale insurance ad included various OOH formats such as bus and MTR:

7. Hang Seng Bank – “Chief Family Officer (CFO)” (2025)

This Hang Seng Bank finance advertising campaign to address the intricate financial needs of modern Hong Kong families. Recognizing that many young affluent families aim for substantial savings goals—averaging HK$18 million—but often lack comprehensive financial plans, the bank introduced enhanced services to bridge this gap. Their "Wealth Master for Family" tool offers personalized asset allocation analyses, assisting families in tailoring strategies for retirement, education, and legacy planning. Complementing this, the "Family+" account facilitates streamlined management of multi-generational finances, including overseas expenditures and investments. The campaign, featuring local celebrities like Sandra Ng, employs relatable storytelling to resonate with families across various life stages, emphasizing Hang Seng's commitment to empowering every family's CFO.

Outdoor ads like this one were seen around the city in the form of billboards and MTR advertising.

Key Takeaways

- Finance ads work best when they’re human.

Whether it’s helping families talk about legacy, encouraging people to believe in their potential, or simplifying day-to-day banking, the most effective campaigns go beyond selling products—they create emotional resonance and build trust. - Cultural relevance drives connection.

Campaigns that succeed in Hong Kong and globally are those that understand local values and social dynamics. From DBS’s AI photobooth to Prudential’s family-focused savings plans, these ads connect because they reflect what matters to their audience. - Digital experience is a brand differentiator.

As more banks and insurers move away from physical branches, the digital interface becomes the face of the brand. Bank ads like Bankwest and Revolut show how ease of use and smart design can become a core part of the marketing story. - Storytelling outperforms feature lists.

Rather than leading with technical details, many of these campaigns use narrative to capture attention, whether it’s a child pursuing their dreams or a person visualizing their future self. Stories are more memorable and more persuasive than product specs.

Sources:

https://www.marketing-interactive.com/hang-seng-bank-empowers-hk-families-with-new-cfo-campaign

https://lbbonline.com/news/bear-meets-eagle-on-fire-bankwest-just-enough-bank

https://www.dbs.com/newsroom/DBS_Launches_Trust_Your_Spark_Campaign_EN

https://financialpromoter.co.uk/revolut-launches-global-campaign-as-part-of-brand-push/

Cookie preferences

Cookie preferences

.jpg)

Xiaohongshu Advertising Guide: How Can Hong Kong Brands Maximize Their Results?

Xiaohongshu Advertising Guide: How Can Hong Kong Brands Maximize Their Results?

2x your advertising effectiveness: Master big data to optimize ad ROI

2x your advertising effectiveness: Master big data to optimize ad ROI

Top 5 Best Ads in 2025 in Hong Kong

Top 5 Best Ads in 2025 in Hong Kong

Hong Kong Outdoor Advertising Cost in 2026 | Adintime Report

Hong Kong Outdoor Advertising Cost in 2026 | Adintime Report

Marketing Calendar 2026: Key Dates For Marketing Success

Marketing Calendar 2026: Key Dates For Marketing Success

The Most Widely-Read Magazine and Newspaper in Hong Kong

The Most Widely-Read Magazine and Newspaper in Hong Kong

Understanding YouTube Advertising Costs in 2025

Understanding YouTube Advertising Costs in 2025

OOH /DOOH advertising in Hong Kong: Formats and Rates (2025 Update)

OOH /DOOH advertising in Hong Kong: Formats and Rates (2025 Update)

How much does LinkedIn Advertising Cost? (2025 Update)

How much does LinkedIn Advertising Cost? (2025 Update)

Top Social Media Platforms in Hong Kong 2025 | Usage Trends & Marketing Insights

Top Social Media Platforms in Hong Kong 2025 | Usage Trends & Marketing Insights